Blockchain technology, originally designed for secure financial transactions through cryptocurrencies, has evolved into a powerful tool in the battle against fraud and cybercrime. In an era where digital threats are on the rise, understanding the role of blockchain in enhancing security and mitigating risks becomes paramount.

Introduction

Defining Fraud and Cybercrime

Fraud and cybercrime encompass a range of malicious activities aimed at deceiving individuals or organizations for financial gain or disruption. As technology advances, so do the tactics employed by cybercriminals, making it imperative to adopt innovative solutions for protection.

Growing Threats in the Digital Age

The digital age has brought unprecedented connectivity but has also opened avenues for sophisticated fraud and cyber threats. From identity theft to financial scams, the stakes are higher than ever. Blockchain emerges as a promising solution to fortify digital landscapes against these evolving threats.

Understanding Blockchain

Basics of Blockchain Technology

Blockchain operates as a decentralized, distributed ledger that records transactions across a network of computers. Each transaction, or block, is linked to the previous one, forming a chain of immutable records. This ensures transparency, security, and trust in the absence of a central authority.

Decentralization and Security Features

The decentralization of blockchain removes the vulnerability associated with centralized systems. Security features like encryption and consensus mechanisms make it extremely difficult for malicious actors to manipulate data or disrupt the integrity of the system.

Blockchain in Financial Transactions

Enhancing Security in Banking

Traditional banking systems face continuous threats from cybercriminals aiming to exploit vulnerabilities in centralized databases. Blockchain’s decentralized nature reduces the risk of a single point of failure, making it more resilient against attacks.

Streamlining Payment Processes

Blockchain facilitates faster and more secure transactions, eliminating intermediaries and reducing the chances of fraud. The use of cryptocurrencies adds an extra layer of security, as transactions are pseudonymous and encrypted.

Identity Verification and Authentication

Immutable Records for Identification

Blockchain ensures the immutability of records, making it ideal for identity verification. Once information is recorded on the blockchain, it cannot be altered or tampered with, providing a reliable and secure method for establishing and verifying identities.

Safeguarding Personal Information

In a world where personal information is a prime target for cybercriminals, blockchain offers a solution by providing users with control over their data. Decentralized identity systems empower individuals to share specific information without compromising their entire identity.

Supply Chain Management

Transparency and Traceability

Fraudulent activities within supply chains can have severe consequences. Blockchain enhances transparency by providing a tamper-proof ledger of every transaction, ensuring the traceability of products from origin to destination.

Counteracting Counterfeiting

The integration of blockchain in supply chain management acts as a deterrent to counterfeiting. Authenticity and origin information stored on the blockchain enable consumers to verify the legitimacy of products.

Smart Contracts for Fraud Prevention

Automating Contract Execution

Smart contracts are self-executing contracts with the terms directly written into code. They automate and enforce contract execution, reducing the risk of fraud associated with manual processing.

Reducing the Risk of Manipulation

By eliminating intermediaries, smart contracts minimize the risk of manipulation or disputes. The terms are transparent, and execution is triggered automatically when predefined conditions are met, ensuring a fraud-resistant process.

Decentralized Apps (DApps) in Cybersecurity

Strengthening Network Security

Decentralized applications, or DApps, built on blockchain, provide enhanced security against cyber threats. The decentralized nature makes it difficult for attackers to target a single point, reducing the vulnerability of traditional centralized systems.

Protecting Against Data Breaches

Blockchain’s cryptographic techniques safeguard data stored in DApps, making it challenging for hackers to compromise sensitive information. This decentralized approach is a significant step in fortifying cybersecurity measures.

Challenges and Concerns

Scalability Issues

Despite its merits, blockchain faces scalability challenges, especially when handling a large number of transactions simultaneously. Solutions such as sharding and layer-two scaling are being explored to address these limitations.

Regulatory Challenges

The regulatory landscape for blockchain technology is still evolving. Ambiguities and differing regulations across jurisdictions pose challenges for widespread adoption and implementation.

Overcoming Challenges

Scalability Solutions

In addressing scalability issues, ongoing research and development focus on solutions like sharding, which involves breaking the blockchain into smaller parts to process transactions more efficiently.

Collaborative Efforts for Regulation

To overcome regulatory challenges, collaborative efforts between industry stakeholders and regulatory bodies are essential. Establishing clear guidelines and frameworks will facilitate the responsible and ethical use of blockchain technology.

Case Studies

Real-World Applications of Blockchain in Fighting Fraud

Several industries have successfully implemented blockchain to combat fraud. Case studies from banking, healthcare, and supply chain sectors highlight the tangible benefits and improved security achieved through blockchain integration.

Future Trends

Continued Evolution of Blockchain Technology

As technology evolves, so will blockchain. Future advancements may include improved consensus mechanisms, enhanced scalability solutions, and integration with emerging technologies like quantum computing.

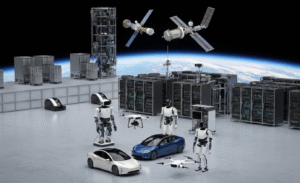

Integration with Artificial Intelligence

The synergy between blockchain and artificial intelligence holds immense potential. Combining the security features of blockchain with the analytical capabilities of AI could revolutionize fraud detection and prevention.

Conclusion

Blockchain technology is a formidable ally in the ongoing battle against fraud and cybercrime. Its decentralized nature, cryptographic security, and transparency make it a valuable tool across various industries. As blockchain continues to evolve and overcome challenges, its role in fortifying digital landscapes is set to expand.

FAQs

- How does blockchain enhance security in financial transactions?

- Blockchain’s decentralization and encryption reduce the risk of a single point of failure, making financial transactions more secure.

- Can blockchain prevent identity theft?

- Yes, blockchain’s immutability ensures that once identity information is recorded, it cannot be tampered with, providing a secure method for identity verification.

- What are smart contracts, and how do they prevent fraud?

- Smart contracts are self-executing contracts with terms written into code. They automate and enforce contract execution, reducing the risk of manual manipulation and fraud.

- How does blockchain tackle supply chain fraud?

- Blockchain enhances transparency and traceability in supply chains, making it difficult for fraudsters to engage in counterfeiting or other fraudulent activities.

- What is the future outlook for blockchain technology?

- The future of blockchain involves continued evolution, addressing scalability challenges, and potential integration with artificial intelligence for enhanced security.