Nearly one in ten individual holders report losing funds to theft or error at some point. That single fact shows the gap between blockchain resilience and everyday user risk.

Cryptocurrency relies on tamper-resistant chains, yet wallets and exchanges remain exposed. Private keys control access to assets, and a misplaced key or weak habit can undo years of gains.

This brief guide will give clear, practical steps and best practices for protecting digital assets without harming usability. You will learn why keys matter, how storage models differ, and which defenses experts use.

Expect actionable advice on wallet selection, layered security—cold and hot storage separation—authentication, secure backups, and recovery planning for inheritance. Small, disciplined habits can cut risk and keep the benefits of self-custody intact.

Key Takeaways

- Private keys are the single point of control for your assets; protect them offline when possible.

- Use a layered approach: hardware wallets, 2FA, and password managers reduce attack surface.

- Diversify storage between cold and hot wallets for daily use and long-term holding.

- Keep software updated and follow clear operational routines for transactions.

- Plan secure backups and inheritance steps to preserve currency and assets for heirs.

Why crypto security matters now

Rising theft and frequent attacks make digital-asset security a present, measurable risk.

In 2022 an estimated $3.8 billion of cryptocurrency was stolen. In 2023 that figure fell to about $1.7 billion, even though the number of attacks rose. These numbers show that theft remains a material threat despite stronger tools and protocols.

The present threat landscape: billions lost despite maturing tools

Most successful breaches do not break blockchain cryptography. Instead, attackers target wallets, exchanges, and users through phishing, malware, and social engineering.

DeFi protocols have driven many incidents from 2021–2023. That means reviewing a protocol’s security record before connecting a wallet is critical, especially on a first-use device.

Blockchains are resilient; wallets, exchanges, and users are the weak link

Internet-connected devices and a single compromised wallet app can expose funds. Hackers focus on weak operational practices like unsafe downloads, reused credentials, and clicking unverified links.

User mistakes also matter. Roughly 17% of all bitcoin may be lost forever due to misplaced keys or damaged seed phrases. Simple habits—keeping small online balances and maintaining device hygiene—lower risk materially.

| Threat | Typical Target | Impact |

|---|---|---|

| Phishing | Wallet credentials and seed phrases | Immediate loss of funds |

| Malware | Internet-connected devices | Key capture and transaction tampering |

| Protocol exploits | DeFi contracts and dApps | Large-scale theft from pools |

Next, the guide turns these risks into concrete steps for choosing a wallet, setting up secure storage, and reducing everyday exposure.

Choosing the right wallet and storage model

Your wallet choice defines control, convenience, and the attack surface for digital assets. Start by deciding who holds your keys: a service (custodial) or you (non-custodial). That decision shapes recovery options, legal exposure, and daily access.

Custodial vs. non-custodial

Custodial wallets, like exchange accounts, hold private keys on behalf of users. They can offer customer support and limited insurance, but they concentrate risk at the provider.

Non-custodial wallets give users direct control of keys. That control increases responsibility for backups and secure storage, but reduces counterparty exposure.

Hot vs. cold models

Hot wallets are connected to the internet and offer fast access for daily transactions. That convenience raises exposure when a device or software is compromised.

Cold wallets keep keys offline and cut the attack surface. They are best for long-term holdings and large balances.

Practical wallet types

- Desktop wallets: Full-featured software for a dedicated device; useful for frequent management with proper device hygiene.

- Mobile wallets: Convenient on a mobile device for on-the-go spending; ideal for small balances and quick access.

- Web-based wallets: Easy access from browsers but more exposed to phishing and browser compromises.

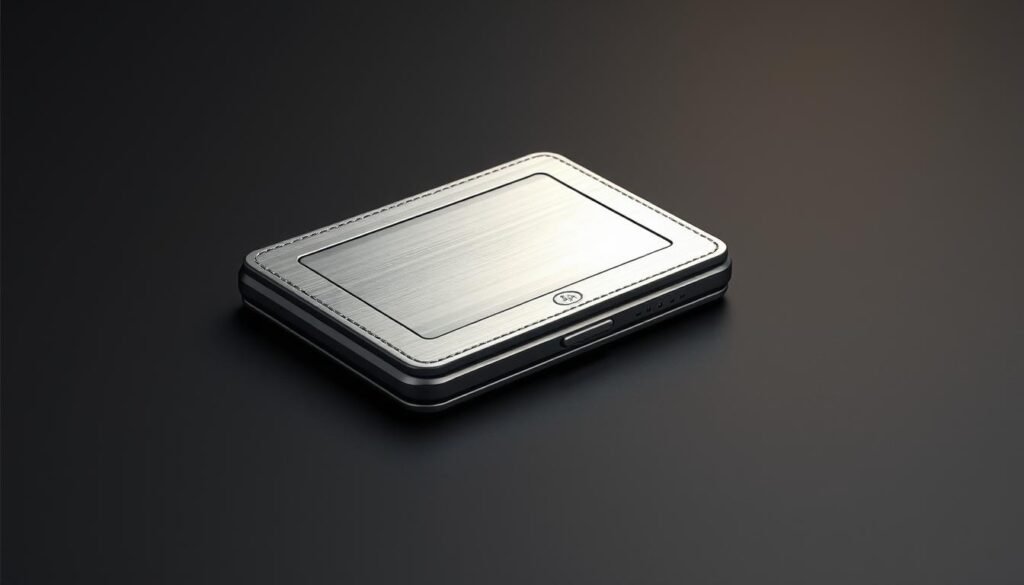

- Hardware wallets: Physical hardware that isolates keys and requires manual approval for transactions, offering strong protection for long-term holdings.

Balance benefits and risk. A common setup pairs a primary non-custodial hardware wallet for holdings and a hot wallet for everyday use. Check access controls, recovery options, and reputable software support when choosing devices and wallets.

Cold storage for maximum protection of digital assets

For long-term holdings, removing private keys from online devices is the strongest way to reduce exposure.

Hardware wallets and setup

Hardware wallets such as Ledger Nano and Trezor store private keys inside secure hardware. They sign transactions on-device so keys never leave the unit.

Initialize the device, generate the seed offline, record that phrase on paper or metal, set a strong PIN, and pair with trusted companion software only when needed.

Paper and alternative cold methods

Paper or metal backups hold your seed phrase without electronics. Encrypted USB drives used on an air-gapped device are another option.

Physical risks include theft, water damage, and fading. Use multiple backups and periodically check their condition.

Best practices for cold wallets

Store devices and backups in secure locations such as a home safe or bank vault. Label and inventory items discreetly so heirs can locate assets without exposing private keys.

Always encrypt digital backups, use a dedicated offline device for recovery, connect hardware only when required, verify addresses on-screen, then disconnect and store.

| Option | Benefits | Risks |

|---|---|---|

| Hardware wallet | Isolated signing, low malware risk, on-device review | Theft, PIN compromise, careless connection |

| Paper/metal seed | Offline, resilient if protected, low tech needed | Physical loss, deterioration, visible to others |

| Encrypted USB (air-gapped) | Digital backup with encryption, portable | Drive failure, accidental online use, key exposure |

How to keep crypto safe with hot wallets and online hygiene

Managing hot wallets well means combining strong credentials, layered authentication, and vigilant software updates.

Strong passwords, password managers, and two-factor authentication

Create long, unique password strings with a reputable password manager and never reuse credentials across wallet accounts or email logins.

Enable multi-factor authentication and prefer authenticator apps or hardware keys over SMS. This extra authentication step cuts the risk of account takeover even if a password leaks.

Beware of phishing; keep wallet software, mobile devices, and PCs updated

Keep operating systems, browsers, and wallet software patched on every device used for transactions. Unpatched software invites malware and web exploits.

Watch for phishing red flags: misspelled domains, urgent payment demands, requests for seed phrases or keys, and fake support chats asking for personal information.

- Use a dedicated browser profile with minimal extensions for wallet sessions.

- Limit funds in hot wallets to small working balances and review connected dApp permissions often.

- Separate daily mobile device use from sensitive wallet work on a cleaner, well-maintained device.

- Protect data at rest: lock screens, enable full-disk encryption, and secure password vaults with a strong master password and 2FA.

Using your crypto safely without unnecessary risk

An operational routine that limits online exposure turns sound storage into practical security.

Operational workflow for transactions

Step-by-step: Start with cold storage, move only the exact amount needed into a hot wallet, complete the transaction, then return remaining funds to cold storage promptly.

Use a dedicated, well-maintained device for signing. Avoid leaving sensitive seed material on any machine that is connected internet beyond the moment of use.

Limit exposure and diversify storage

Keep small balances in hot wallets for daily needs and split long-term holdings across multiple secure locations such as a home safe and a bank safe-deposit box.

Label holdings and budget allocations so day-to-day spending and long-term store cryptocurrency allocations never mix by accident.

Safeguard keys, backups, and recovery

Make encrypted backups of wallet files and seed phrases, keep at least two copies in different places, and test recovery regularly. Use metal backups, tamper-evident bags, and access logs for seed phrase protection.

Multisignature setups reduce single-point-of-failure risk for higher-value assets but require coordination and clear recovery rules. Document procedures for heirs and executors so they can access digital assets without exposing private keys prematurely.

“Limit live exposure: move only what you need and return the rest.”

Conclusion

Simple, repeatable steps separate most users from common attack paths and errors.

Favor cold storage for long-term holdings and use a hot wallet only for small, active balances. Hardware wallets such as a Ledger Nano or a Trezor isolate keys and cut exposure during transactions.

Record seed phrases on paper or metal and keep copies in different secure places like a home safe or a bank safe-deposit box. Maintain updated software, strong password hygiene, and layered authentication to reduce theft and social-engineering risk.

Verify sources before sharing personal information or payment details, return funds to cold storage after use, and review your storage and devices regularly. Security is a process—small habits protect currency and make protecting digital assets reliable over time.

FAQ

What is the difference between custodial and non-custodial wallets?

Custodial wallets are run by third parties like exchanges or custodial services that hold your private keys and handle transactions on your behalf. Non-custodial wallets — desktop, mobile, hardware, or paper wallets — give you sole control of private keys. Control of keys means control of funds, so non-custodial setups require stronger personal security and reliable backups.

Are hardware wallets such as Ledger Nano and Trezor worth using?

Yes. Hardware wallets store private keys offline in a dedicated device, reducing exposure to online threats. Devices from Ledger and Trezor protect against many malware and phishing attacks, support PIN authentication, and allow secure transaction signing. They are recommended for holding significant balances or long-term holdings.

What is cold storage and how does a paper wallet compare?

Cold storage refers to keeping private keys completely offline. Paper wallets store seed phrases or private keys on printed paper and avoid internet access, but they face risks like fire, water damage, and physical theft. Hardware wallets offer more secure key storage and controlled transaction signing while maintaining offline protection.

How should I back up seed phrases and private keys?

Write seed phrases on non-reactive material like metal plates or acid-free paper and store copies in separate secure locations such as safe deposit boxes or fireproof safes. Avoid digital backups on cloud drives or phones. Consider encrypted backups and a clear recovery plan for inheritance or emergencies.

When should I move funds from cold storage to a hot wallet?

Only move the exact amount needed for spending or trading, and transfer it back to cold storage immediately after the transaction. This operational workflow limits exposure on devices that stay connected to the internet and reduces the window for theft or compromise.

What are best practices for hot wallets and online hygiene?

Use unique, strong passwords and a reputable password manager; enable two-factor authentication (2FA) by app or hardware token, not SMS; keep wallet software and device OS updated; install apps from official sources; and never enter seed phrases into a browser or mobile app. Regularly scan devices for malware and avoid public Wi‑Fi for transactions.

How can I recognize and avoid phishing and social engineering attacks?

Verify URLs and extension details before signing in, confirm emails and messages come from official addresses, and never disclose private keys or seed phrases. Double-check transaction details on your hardware wallet display before approving. Treat unsolicited support requests and links with extreme caution.

What role does multisignature (multisig) play in securing assets?

Multisig requires multiple independent signatures to move funds, spreading trust across devices, people, or services. It reduces single-point-of-failure risk and is useful for businesses, estates, or shared control. Properly implemented multisig improves security but requires careful key management and recovery planning.

Is insurance or a bank-like custodial service a good option?

Custodial services can offer convenience and institutional features, sometimes including insurance coverage. However, they reintroduce counterparty risk: if the provider is hacked, insolvent, or compromised, access to funds can be affected. Evaluate reputation, regulatory status, and insurance scope before trusting custodial providers.

How should I secure mobile and desktop wallets?

Lock devices with strong passcodes and biometric options, install updates promptly, use reputable wallet apps, and enable device-level encryption. Keep small spending balances on mobile wallets and limit app permissions. Pair mobile wallets with hardware wallets when possible for transaction signing.

What is the safest way to handle transactions involving large sums?

For large transfers, use a hardware wallet or multisig setup and test with a small transaction first. Verify all addresses manually, ideally on an offline device or hardware display. Consider using a VPN and secure network for added privacy, and document the transfer procedure to reduce human error.

How do I protect my keys and assets from physical threats like theft or disasters?

Store hardware devices and paper or metal backups in secure, geographically separated locations such as bank safe deposit boxes or home safes. Use tamper-evident packaging, and consider redundancy with clear recovery instructions. Avoid revealing asset locations or holdings publicly.

What steps help with inheritance and recovery planning?

Create a written recovery plan that names trusted executors and explains how to access encrypted backups without exposing seed phrases publicly. Use legal instruments, secure key-splitting schemes, or multisig arrangements to balance access and security. Regularly review the plan for changes in technology and personal circumstances.

Can encryption and password managers improve security?

Yes. Encrypt backups and use a reputable password manager for strong, unique passwords. Store master passwords securely and consider hardware-based authentication like YubiKey for account access. Avoid storing unencrypted seed phrases or private keys on cloud services or email.

What common mistakes put digital assets at risk?

Common errors include sharing seed phrases, using weak passwords, keeping large balances on exchanges or hot wallets, clicking unknown links, and skipping software updates. Overlooking backups or failing to plan for recovery also leads to permanent loss of funds.

Which wallet type should I choose for everyday use?

For everyday spending, use a mobile or web wallet with small balances and strong security hygiene. Pair it with a hardware wallet for larger holdings. The right mix balances convenience and protection based on how often you transact and how much you store online.